RTF reverse copper foil

Category:

Keywords:

Product Description

- 产品描述

-

Hongye Copper Foil's reverse copper foil, also known as RTF reverse copper foil, differs in processing direction from other copper foils. Specialized machines process the glossy side of the foil, while other machines handle the matte side. RTF reverse copper foil is mainly used in high-frequency, high-speed circuit boards, such as those for 5G servers. We are one of the only companies in China capable of mass-producing PCB copper foil for high-frequency, high-speed circuits, holding an absolute leading position in the RTF reverse copper foil field.

Reverse copper foil, with its glossy surface treatment, offers superior etchability, effectively reducing processing time, increasing speed, and enabling rapid micro-etching, thus improving the yield rate of printed circuit boards. It is mainly used in multilayer boards and high-frequency boards.

5G Industry and Copper Foil Demand

It is estimated that the total 5G investment by China's three major operators will exceed 1.3 trillion yuan, representing a growth of over 60% compared to the 4G era. In the initial stages of 5G commercialization, operators will conduct large-scale network construction, and the equipment manufacturing revenue generated by 5G network equipment investment will be the main source of direct economic output from 5G. It is estimated that in 2020, the combined revenue from network equipment and terminal equipment will be approximately 450 billion yuan, accounting for 94% of the total direct economic output. In the mid-term of 5G commercialization, expenditure from users and other industries on terminal equipment and telecommunications services will continue to grow. It is estimated that in 2025, these two expenditures will be 1.4 trillion yuan and 0.7 trillion yuan respectively, accounting for 64% of the total direct economic output. In the later stages of 5G commercialization, the revenue from internet companies' information services related to 5G will increase significantly, becoming the main source of direct output. It is estimated that in 2030, internet information service revenue will reach 2.6 trillion yuan, accounting for 42% of the total direct economic output.

High-frequency PCBs refer to signals in the millimeter-wave frequency band (0.3-3 THz) of the "microwave" band. Currently, PCBs used in 5G, automotive communication, and some consumer electronics products are developing towards the millimeter-wave circuit field, and electronic copper foil will become one of the indispensable main raw materials.

Copper-clad laminate (CCL) is a key raw material for manufacturing printed circuit boards (PCBs) and is also a user and downstream product of electronic copper foil. FR-4 is the mainstream product of glass cloth-based copper-clad laminates, mainly used in high-end products such as computers, communications, and mobile phones. Although China has become the world's largest producer of copper-clad laminates, low-end laminates based on paper substrates still account for a considerable proportion. The market prospects for mid-to-high-end copper-clad laminates such as FR-4 glass cloth-based laminates are broad, with product added value far exceeding that of paper-based laminates. Moreover, after years of development, domestic production equipment and process technologies have become more mature and stable.

Lithium battery copper foil, as an emerging market for high-end copper foil, is experiencing rapid growth in demand. According to national statistical data, it is predicted that by 2020, the domestic market for electric vehicles will have at least 5 million units, and with an annual market input of 500,000 to 1 million units, the lithium battery copper foil consumption per electric bus and electric truck will be no less than 200 kg, and the lithium battery copper foil consumption per electric passenger car will be no less than 30 kg. The annual market demand for lithium battery copper foil for electric vehicles is approximately 90,000 to 150,000 tons, which is close to the market demand for copper foil for copper-clad laminates. Lithium batteries are not only widely used in mobile phones, laptops, electric vehicles, and electric bicycles, but also in aerospace, artificial satellites, and energy storage. Due to their small size, high capacity, and multiple charge-discharge cycles, lithium batteries have obvious advantages in the field of energy storage to address the imbalance between peak and off-peak electricity consumption in power grids. It is predicted that its market prospects can be comparable to the electric vehicle market. The broad development prospects of lithium batteries also bring huge development space to the lithium battery materials industry.

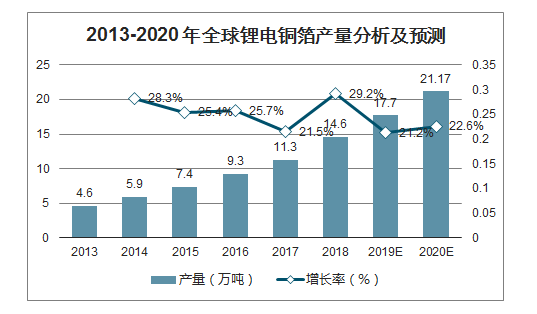

From a global perspective, in 2018, global lithium battery copper foil production increased by 29.20% year-on-year, reaching 146,000 tons. In the next few years, driven by the growth of the global lithium-ion battery market, especially the demand for lithium battery copper foil from power batteries, the global lithium battery copper foil market will maintain a high growth trend. It is expected that the production will continue to grow at a CAGR of 24% in the next four years, exceeding 200,000 tons by 2020.

Analysis and Forecast of Global Lithium Battery Copper Foil Production from 2013 to 2020

Data Source: Compiled from Public Information

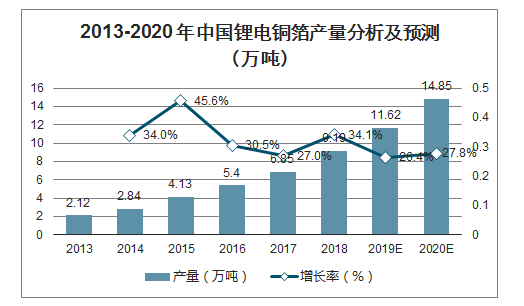

In 2019, China's lithium battery copper foil production was 116,200 tons. In the next few years, under the background of strong government support for the new energy vehicle industry, power batteries will drive the rapid growth of China's lithium battery copper foil market. It is expected that China's lithium battery copper foil production will reach 148,500 tons by 2020.

Analysis and Forecast of China's Lithium Battery Copper Foil Production from 2013 to 2020 (Ten Thousand Tons)

Data Source: Compiled from Public Information

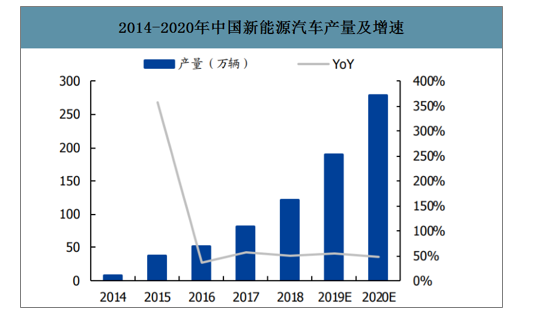

Production and Growth Rate of New Energy Vehicles in China from 2014 to 2020

Data Source: Compiled from Public Information

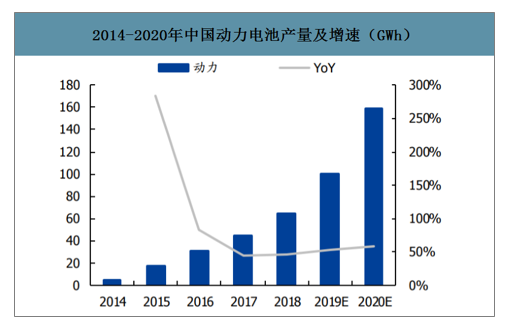

Production and Growth Rate of Power Batteries in China from 2014 to 2020 (GWh)

Data Source: Compiled from Public Information

Under the rapid development of the 5G industry, the production capacity of PCB copper foil has not yet experienced rapid growth. However, the PCB industry is affected by the booming development of the 5G market. As an indispensable electronic component in the industry chain, the future demand for its raw materials CCL and PCB copper foil is very large, and the supply and demand situation of PCB copper foil will be marginally improved.

In the long term, the accelerated penetration rate of new energy vehicles, coupled with the higher demand for batteries in the 5G era, will significantly increase the demand for lithium battery copper foil.

1.3 Copper-Clad Laminate Market Analysis

Copper-clad laminate, abbreviated as CCL, is the main upstream material for manufacturing printed circuit boards (PCBs). It is crucial for the performance, quality, processability during manufacturing, and manufacturing cost of PCBs.

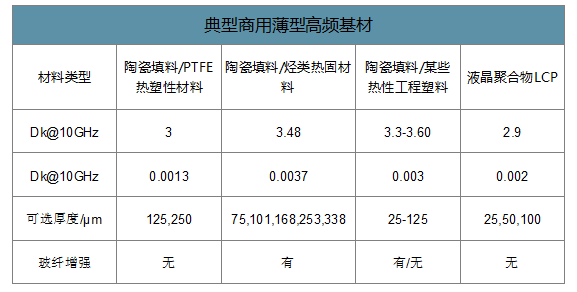

To meet the needs of high-frequency circuits, current CCL manufacturers are mainly improving the substrate materials from the following three aspects: Resin modification: using resin systems with lower polarity and smaller dielectric constant (Dk)/dissipation factor (Df); Glass fiber modification: Glass fiber reinforcement materials are the main bearers of mechanical strength in composite materials. By reasonably mixing and matching different types of glass fibers, a balance between dielectric properties, processing properties, and cost can be achieved. Adjusting PCB dielectric layer distribution: In addition to modifying the substrate material itself, the dielectric properties of the substrate can also be improved by adjusting the distribution of multiple dielectric layers. That is, only low Dk/Df high-frequency materials are used in the dielectric layers that affect high-frequency signal transmission. Because the price of high-frequency materials is much higher than that of conventional FR-4 materials, the mixed-pressure laminated structure of high-frequency and conventional materials can effectively reduce costs. Currently, commercialized high-frequency, high-speed copper-clad laminate products include two major categories: thermoplastic and thermosetting. Specific examples include PTFE/ceramic filler substrates, hydrocarbon thermal/ceramic materials substrates, thermoplastic engineering plastics/ceramic filler substrates, and LCP substrates (the possibility of new composite materials emerging in the future is not ruled out). When selecting materials, manufacturers consider not only substrate loss but also the processability of the material itself. In the future, diversification of resins such as PTFE fluoropolymer, hydrocarbon resins, and polyphenylene ether will become a trend.

Typical commercial thin high-frequency substrate

Data Source: Compiled from Public Information

With the communication industry developing from low frequency to high frequency, the application market of high-frequency high-speed copper-clad laminates is broad. In recent years, the main commercial application areas are mainly automotive electronic millimeter-wave radar. Under the trend of automotive automation, electrification, entertainment, and networking, the penetration rate of assisted driving systems is gradually increasing, and the shipment volume of automotive radar is increasing year by year, which will continue to drive the demand for ultra-high frequency circuit substrates. This is the main "small blue sea" market for suppliers with the ability to mass-produce related products before the arrival of the 5G large-scale investment period. The growth rate of this market is expected to increase significantly after the completion of 5G network construction. We predict that the cumulative demand for high-frequency copper-clad laminate substrates brought by global automotive millimeter-wave radar from 2018 to 2025 will be approximately 16.5 billion yuan.

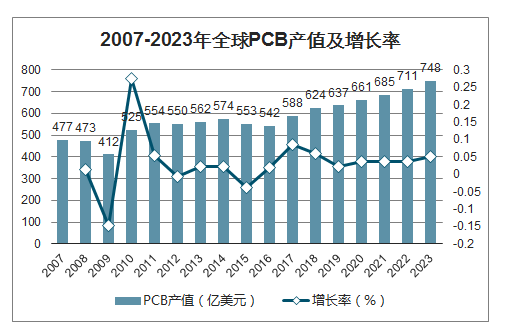

In 2018, the global PCB industry's total output value reached US$62.396 billion, a year-on-year increase of 6.0%. It is predicted that the global PCB market will maintain moderate growth in the next five years, and the Internet of Things, automotive electronics, Industry 4.0, cloud servers, and storage devices will become new directions driving the growth of PCB demand.

Global PCB Production Value and Growth Rate from 2007 to 2023

Data Source: Public Data Compilation

Benefiting from the global transfer of PCB production capacity to China and the booming downstream electronic terminal product manufacturing, China's PCB industry has shown a relatively rapid development trend. In 2006, China's PCB output value exceeded that of Japan, making China the world's largest PCB manufacturing base. Stimulated by the strong growth in demand from downstream fields such as communication electronics, computers, consumer electronics, automotive electronics, industrial control, medical devices, national defense, and aerospace, China's PCB industry growth rate in recent years has been significantly higher than the global PCB industry growth rate. In 2018, China's PCB industry output value reached US$32.702 billion, a year-on-year increase of 10.0%.

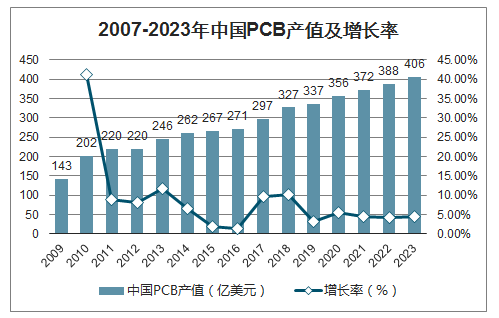

China's PCB Production Value and Growth Rate from 2007 to 2023

Data Source: Public Data Compilation

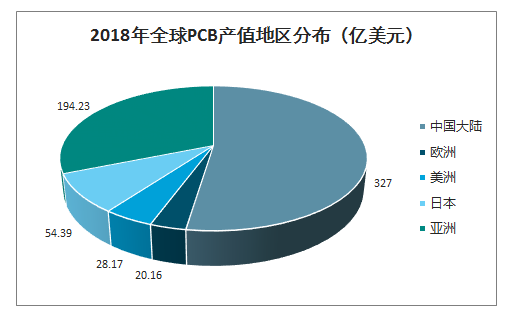

Global PCB Production Value Distribution by Region in 2018 (US$ billion)

Data Source: Public Data Compilation

The PCB industry in mainland China has already occupied half of the world. In 2017, the PCB production in mainland China accounted for more than 50% of the global PCB production, and has become half of the PCB industry. The PCB industry scale in the US, Japan, and Europe is still shrinking. Mainland China, with its lower labor costs and government investment attraction and encouragement policies, will continue to increase its share in the future. The trend of PCB industry moving east continues. With the improvement of the technical strength of PCB manufacturers in mainland China, the gap with foreign enterprises will gradually narrow. Judging from the expansion pace of PCB manufacturers, most of the capacity release in the next 1-3 years will mainly come from domestic manufacturers. Taiwan's PCB companies have relatively less capacity expansion in this expansion process, and leading domestic manufacturers may lead the growth of PCB production value in mainland China.

Leave a message

We attach great importance to your opinions and inquiries. If you have any questions about our products and services, please fill out the following form, and we will contact you as soon as possible.